As automakers race to develop battery-electric cars, they’re constantly racing for whatever will give them an edge over their rivals.

After announcing it would produce “solid-state” batteries in early 2027, Toyota on Tuesday revealed ambitions to halve the size and cost of power units for its electric vehicles to make them safer and charge faster.

But despite the Japanese auto group’s optimism, this holy grail battery technology has long eluded the industry.

Smaller, lighter, safer and faster

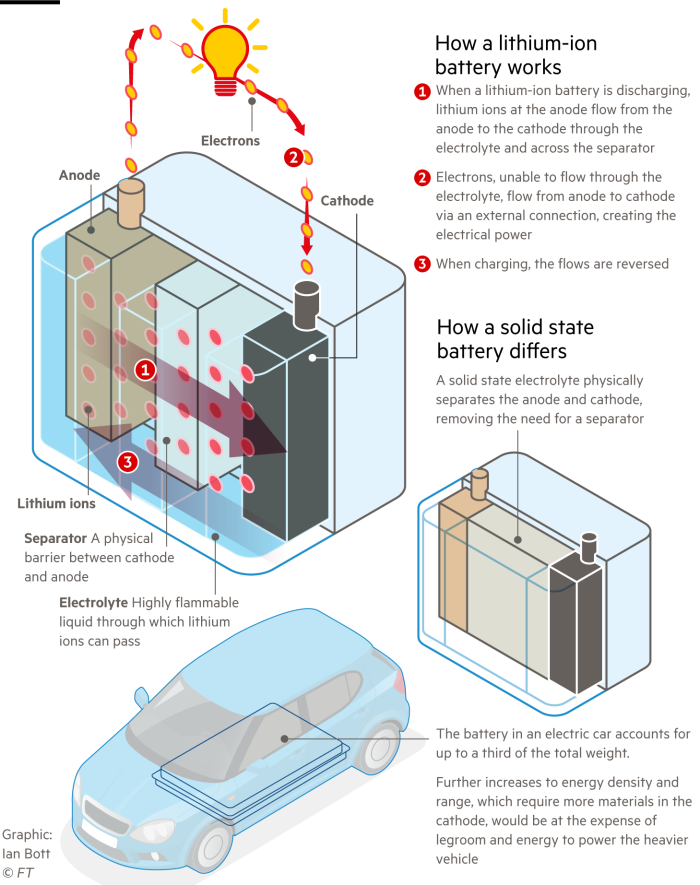

From the most expensive Tesla to the cheapest Fiat, electric vehicles on the market today use batteries that have a liquid lithium-ion electrolyte.

The electrolyte allows current to pass through the battery between the two electrodes – the anode and the cathode – to generate power.

But EVs that use liquid batteries have some well-documented drawbacks, such as being very heavy and taking longer to recharge than it takes a petrol car to refuel. They can also catch fire, especially if the battery overheats.

So-called solid-state battery technology, which uses a solid electrolyte, could potentially solve this problem.

Batteries can store more power, making it smaller without reducing range. They can charge really fast without getting hot, making them much safer.

Toyota says it expects its EVs powered by solid-state batteries to have a range of 1,200 km – more than twice the range of current EVs – and a charge time of 10 minutes or less.

Where the anode and cathode meet

Despite years of global investment, the technology is still nascent.

Therefore, establishing a precise timeline is difficult.

Toyota says it is confident it can commercialize the technology into vehicles by 2027. While this is only four years away, this supersedes the earlier target of 2025 that the automaker originally set in 2017 and then reaffirmed in 2021, when it said it could be done. using the battery in the hybrid model.

“Top management. . . have asked me if we can really do it [by 2027],” Keiji Kaita, Toyota’s top battery expert and president of its research and development center for carbon neutrality, said on Tuesday. “But I gave them evidence while we were working on it.”

But despite their beliefs, battery researchers have watched the schedule roll back time and time again.

“A lot of developers have been saying ‘within five years’ over the last 10 years,” said Victoria Hugill, battery research analyst at consultancy Rho Motion.

Experts also expect semi-dense batteries to reach commercial use more quickly than fully-dense ones.

The main challenge for solid-state battery developers is getting solid contact between the electrodes – where the lithium-ion is stored – and the electrolyte that facilitates movement between them, he added.

Shirley Meng, a professor of batteries at the University of Chicago, told a Financial Times conference that solid-state batteries also need to operate at a certain pressure “to function at optimal levels”, which remains a technological challenge for manufacturers. “This needs to be resolved before the technology really takes off,” he added.

Seek technological advantage

Toyota has long resisted embracing fully electric cars like those of its biggest rivals such as VW and Ford.

He argued that they were too expensive for developing markets, that charging would be difficult in countries with poor power grids, and that using the world’s limited lithium resources in hybrids would lower overall emissions more quickly.

But solid-state technology, which is far more expensive to produce than traditional battery systems and still requires power to recharge, doesn’t seem to have the answer to all of these problems.

As competition to develop solid-state batteries heats up, being first on the market is sure to help Toyota gain an edge in segments that are slower than rivals in launching models.

The Japanese group thinks its 20 years of experience with hybrid batteries will help it develop better EVs. However, its major EV rollout is not expected to begin until the middle of this decade.

Despite the hype surrounding the announcement, Toyota executives themselves are adamant they are not simply betting on solid-state batteries and expect further technological breakthroughs to be made with liquid lithium-ion batteries.

“We don’t really see solid-state batteries as the ultimate solution,” said Toyota chief technology officer Hiroki Nakajima.

Solid-state battery competition is increasing

Perhaps unsurprisingly, many automakers are investing in the technology, hoping to steal the march on electric vehicles. BMW has said it will start testing solid-state cells this year, with a development vehicle expected before 2025. However, it realistically doesn’t expect mainstream manufacturing until later in the decade.

Nissan has launched a prototype battery facility in Japan to manufacture vehicles using the technology by 2028, a year after Toyota’s latest target. The company says it will reduce battery costs to $75 per kilowatt hour over 2028 and to $65/kWh later, which will make its EVs cost the same as gasoline-powered vehicles.

Toyota’s Kaita added that the company aims to solve the problem of high costs by simplifying the number of processes needed to make battery materials.

Start-ups like QuantumScape, which is backed by Bill Gates and Volkswagen, have also been developing solid-state battery technology.

In 2015, vacuum maker Dyson bought Sakti3, a solid-state startup, which it believes will help it break into the auto industry. Technological delays are one of the reasons why 2019 withdrew plans to build vehicles.

However the company is continuing to develop its battery system and is building a factory in Singapore which is expected to produce some form of non-liquid battery from 2025, indicating that the company has made significant inroads.

Displays ambition

Since appointing a new president in April, Toyota has been trying to change its image as a laggard EV, following pressure from shareholders to explain how it plans to stay ahead of the global race for battery-powered vehicles.

In June the Japanese automaker took reporters on a rare tour of its technical center near Mount Fuji, where it showcased not only its ambitions for next-generation liquid and solid-state lithium-ion batteries, but also a new manufacturing method that will make them even simpler. and faster to produce electric vehicles.

“We weren’t good at promoting ourselves and because we were being too careful, people just realized we were working [on a certain technology] after the product is finished,” said Kaita, revealing that the company had made an initial breakthrough on the issue of solid-state battery life three years ago.

Executives usually divulge few details about “technological breakthroughs”, with Nakajima saying only that the company has found a promising material for solid-state batteries.

This has led some shareholders to question Toyota’s progress, saying that the lack of details on specific “breakthroughs” does not make them confident of achieving their goal by 2027, and asking whether the announcement was simply meant to calm investors’ concerns about the overall outcome. EV approach.

But Toyota still set the date. “2027 will be challenging for us,” said Nakajima, “but that doesn’t mean we don’t have a foundation [for the date].”

Additional reporting by Eri Sugiura and Harry Dempsey in London

#hopes #hype #Toyotas #solidstate #batteries