- GBP is rallying after a soft start to July

- Seems to reboot the H1 better performance

- Barclays is now bullish on GBPEUR

- Goldman Sachs maintains a constructive stance

- NatWest Markets is wary of the negative impact of rising mortgage rates

Image © Adobe Images

The British pound found some life after a lackluster start to July and foreign exchange strategists said this month could see the British currency continue to benefit from rising UK interest rates.

The yields on the UK two-year bonds are proving an attractive proposition for yield-hungry international investors as they remain near their highest since 2008, as markets move to price further rate hikes at the Bank of England.

“2-year Gilt yields jumped 150bps in the past two months. This helps explain why GBP was the best performing G10 currency in the first half of the year,” said Derek Halpenny, Head of Research for Global EMEA Markets at MUFG Ltd.

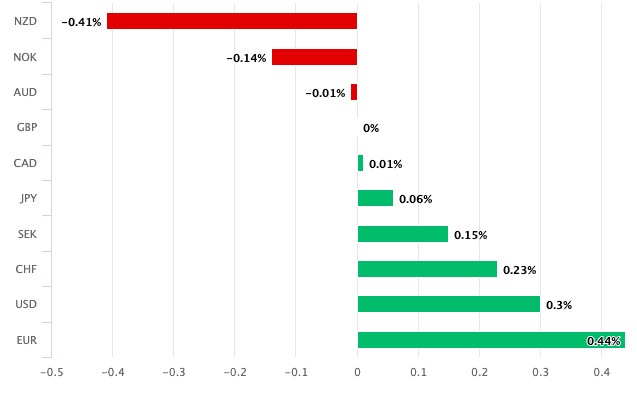

The pound was the best-performing major currency in the first half of 2023 as it rose in value across the G10 amid a better-than-expected UK economic performance and a hike in interest rates at the Bank of England.

“We think GBP should outperform because the real rate needs to move higher,” said Michael Cahill, foreign exchange analyst at Goldman Sachs.

The Pound to Euro exchange rate peaked at a 14-month high of 1.1738 towards mid-June and the Pound to Dollar exchange rate peaked at 1.2848. However, both pairs have since eased back suggesting the rally has entered a consolidation phase at the start of the new month and fiscal quarter.

But the weekly currency research report from strategists at Barclays maintains a positive stance on the Pound’s outlook as a hike in UK interest rates is anticipated to support global investor demand for British assets.

“We have become more positive on the pound in the near term,” said Barclays, adding they had become more positive on the pound-to-euro exchange rate in particular.

Driving constructive sentiment in the Pound Sterling are high expectations for Bank of England Bank Rate to peak near 6.0% have boosted UK bond yields, which in turn attracted investment capital inflows.

Research from Deutsche Bank revealed an unexpectedly large spike in demand for bonds from domestic retail investors as the UK public “stepped in” to fund the indebted government. International investors have also come to the fore, preferring British bonds to lower interest rates in what is known as a ‘carry’ trade, which has the effect of underscoring demand for the Pound.

Above: GBPEUR at 15 minute intervals.

Stickier inflation and more proactive tightening should maintain carry support for the pound, said Barclays.

The first half of 2023 coincides with a shift in attitude at the Bank of England from cautious to more assertive given persistently stubborn inflation.

“The recent surprise 50bp hike by MPC suggests a more (long overdue) more proactive stance on inflation,” said Barclays.

But analysis from NatWest Markets suggests caution as the Pound is likely to only be supported in this high interest rate environment provided growth remains strong. Hence, high interest rates but low growth environment will not support currency valuation, which is what analysts at banks are wary of in H2.

“Sterling is expected to maintain a large yield premium over the EUR over the next 3 years and have a steadily increasing premium over the USD. The extent to which this supports Sterling will depend on the collateral damage it causes to the UK economy,” said Paul Robson, Head of Strategy at G10 FX for EMEA at NatWest Markets.

Above: GBP’s performance against its G10 peers on July 04.

NatWest Markets recently recommended short positions in the Pound, eyeing its vulnerability given the expected slowdown in the economy linked to rising mortgage rates expected to weigh on consumers’ health.

But strategists at Barclays find that Britain’s inflation problems are underscored by an economy still marked by excess demand.

“While further tightening could ultimately weigh on growth, the UK’s inflation woes are a symptom of resilient demand amid a tight labor market and reduced aggregate supply, in our view. The resilient sentiment survey supports this interpretation,” Barclays said.

A survey in June revealed consumer confidence continues to improve with the much-watched GfK reading showing improvement for the fifth month in a row. Lloyds Bank Business Barometer meanwhile revealed business confidence rose to a 14-month high in June.

“As such, higher interest rates are likely to increase sterling’s already sizeable carry advantage, even as the bar for a further hawkish surprise relative to market prices remains high. The final PMI stands out in this week’s data.”

#Pound #Sterling #solid #progress #extend #run #July #Barclays #Goldman #Sachs